In our today’s topic we are going to cover best cryptocurrency exchanges one by one based on popularity and reputation in the markets of cryptocurrency. The detailed reviews, supported fiat currencies, supported countries, and supported coins are well explained in this article.

Also see: Cryptocurrency Broker and Exchange Reviews

Best cryptocurrency exchanges in 2020

- Bitmex

- Bittrex

- Coinbase

- Binance

- Poloniex

- Kucoin

- Changelly

- Coinmama

- Ternion Exchange

- Karaken

- Bitfinex

- Huobi

- LocalBitcoins

- Bitstamp

- CEX.io

- Gemini

[button color=”orange” size=”big” link=”https://tokenhell.com/engine” icon=”” target=”true” nofollow=”true”]Start Trading LTC With Crypto Engine Bot Now[/button]

[divider style=”solid” top=”20″ bottom=”20″]

Best Cryptocurrency Exchanges 2020 step by step walk through

1. Bitmex

Bitmex started its journey in 2014 and founded by HDR Global Trading Limited. Bitmex only accepts bitcoins for deposits and withdrawals but also support contracts for various cryptocurrencies. The marked feature of this platform is its margin trading services that makes it different from other exchanges.

Through margin trading, one can place the orders greater than the balance in wallets and ultimately generate more profits than simple trading. Bitmex offering leverage up to 100x to its users.

[one_half]

Pros

[tie_list type=”thumbup”]

- Margin trading services

- Low fees

- Leverage up to 100x

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- Deposits only in bitcoin

- A bit complex for beginners

[/tie_list]

[/one_half_last]

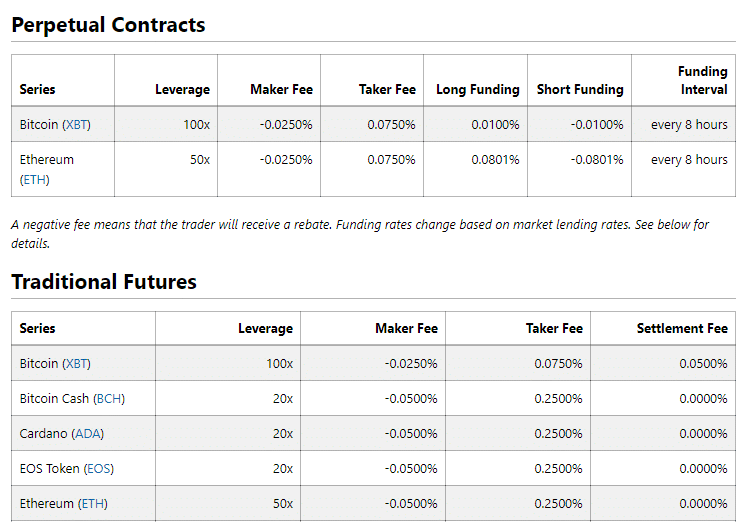

Bitmex offers perpetual contracts side by side with normal future contracts that have no expiry. Besides perpetual contracts, there are other two types of contracts available for traders such as upside profit contracts and downside profit contracts.

Bitmex has global access except for the following countries:

[tie_list type=”cons”]

- Iran

- Sudan

- Cuba

- Crimea

- North Korea

- Canada

- Syria

- United States of America

[/tie_list]

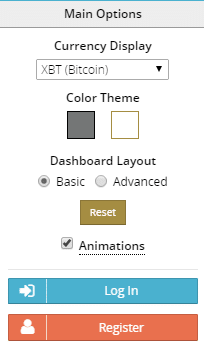

There are two options for the dashboard layout; one is basic that can be easily understandable to the beginners while the advance is for those who are trading for years.

Following cryptocurrencies supported on Bitmex:

[tie_list type=”checklist”]

- Bitcoin (XBT)

- Cardano (ADA)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Ripple Token (XRP)

- Monero (XMR)

- Dash (DASH)

- Zcash (ZEC)

- Tron (TRX)

- Litecoin (LTC)

- EOS Token (EOS)

[/tie_list]

The fee schedule is very low than most of the exchanges. There are different fee schedules for perpetual contracts and traditional contracts.

In short, Bitmex is a top-rated exchange with its remarkable feature of leverage. But it is suitable for professional traders of bitcoin and can be difficult for new users who are not already familiar with the Bitmex. They should use basic interface in the beginning and seek the chat room for help.

[divider style=”solid” top=”20″ bottom=”20″]

2. Bittrex

Bittrex came into existence in 2014 with its native city Seattle, USA and regulates under the laws implemented by the U.S government. For the security and verification process of users, it is working with Jumio, a digital ID solution provider.

Bittrex is on the top in terms of security and is not attacked or breached by any hacker attack until today that maintains its reputation as a secure exchange for trading. Bittrex supported a wide range of cryptocurrencies; total numbers of crypto pairs on the exchange is 264.

[one_half]

Pros

[tie_list type=”thumbup”]

- Full security

- A lot of trading pairs

- No fees on deposits and withdraws

- Easy to use interface

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- Complaints about suspending accounts

- Poor-functional support

- Higher fees than average

[/tie_list]

[/one_half_last]

Accounts are grouped into three types depending on the withdrawal limits of BTC: unverified account, basic account, and enhanced accounts. With the new or unverified account, you are unable to draw any BTC while you can withdraw up to 4 BTC with the basic account in 24 hours. For the enhanced account, you can withdraw up to 100 BTC in 24 hours.

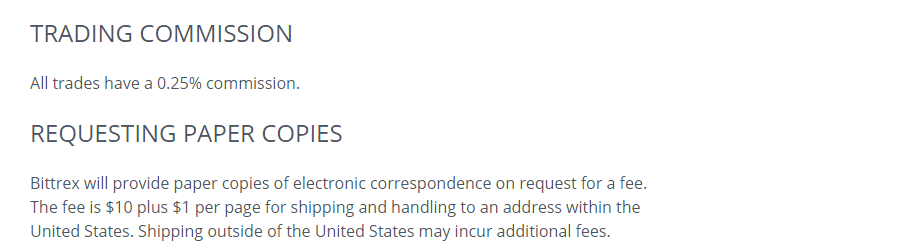

The fee structure of Bittrex is very tough in comparison to other exchanges; charges flat rate of 0.25% on all trades; but there is no commission on deposits and withdraws.

Although it has easy to use interface but still it is not favorable for beginners due to its poor performance of support. Moreover, its process of suspending accounts without prior notice makes it doubtful and vague. But if you want full security, then it is the best exchange for you.

[divider style=”solid” top=”20″ bottom=”20″]

3. Coinbase

Coinbase entered in the trading world in 2012 and founded by Brian Armstrong and Fred Ehrsam. Coinbase offers services for buying and selling cryptocurrency while Coinbase Pro is a trading platform for professional traders and investors.

Transaction fees of BTC are low on Coinbase Pro rather than simple Coinbase platform and also have advanced trading tools.

Coinbase supports the following countries:

Italy, USA, Czech Republic, Finland, Norway, Switzerland, San Marino, Denmark, Poland, Serbia, Sweden, Portugal, United Kingdom, Romania, Spain, Iceland, Croatia, Austria, Netherlands, Latvia, Andorra, Mexico, Luxembourg, Bulgaria, Hungary, Belgium, Lithuania, Greece, Monaco, France, Singapore, North America, Slovakia, Cyprus, Malta, Guernsey, Ireland, Estonia, Slovenia, Jersey, Liechtenstein and Gibraltar and others.

[one_half]

Pros

[tie_list type=”thumbup”]

- Buying limits are high

- Average fees

- Simple interface for beginners

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- No full control on your wallet

- Tracking accounts of users

- Poor support

[/tie_list]

[/one_half_last]

US users have a lot of benefits such as they can purchase BTC of worth $1000 in a week. Moreover, US users can reach up to the highest limit that is $25000 in 24 hours.

There are following coins are listed on the exchange:

Bitcoin (BTC), Litecoin (LTC), Augor (REP), USD Coin (USDC), Ethereum (ETH), Stellar Lumens (XLM), Dai (DAI), Bitcoin Cash (BCH), Ripple (XRP), Zcash (ZEC), Basic Attention Token (BAT), Ethereum Classic (ETC), 0x (ZRX), and EOS.

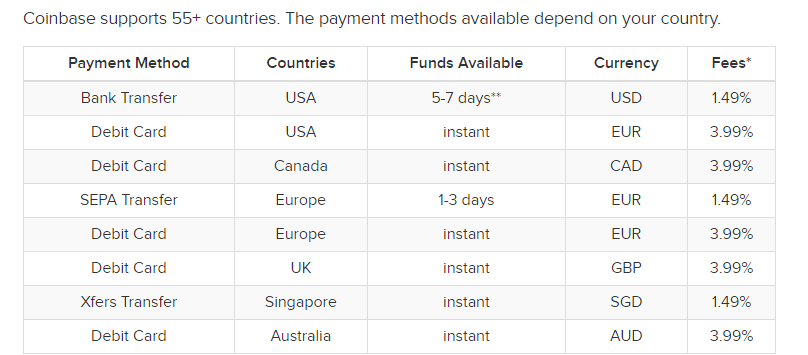

Coinbase deducts 3.99% on deposits from credit card transfers while 1.49% on bank transfers, definitely expensive prices. Similarly, they charge $0.10 while withdrawing BTC.

Coinbase allows its users to use a wide range of payment methods with different fee-rates based on the geographical region of the members.

The fee structure can be seen here: Coinbase Pricing and Fee Disclosures.

Although there are many complaints and negative reviews, Coinbase is the world’s largest cryptocurrency exchange that giving its customers two tastes; one is traditional brokerage service while the other one is Pro Coinbase trading platform.

4. Binance

Binance had started its mission to facilitate the trading of the cryptocurrency in 2017 under the supervision of Changpeng Zhoa, founder of Binance. Binance raised almost 15 million dollars through its ICO campaign, which laid its strong roots.

Binance has its token called Binance Coin (BNB) that got value with the emergence of exchange. It offers the exchange of digital money and there is no role of fiat currency at all. Binance is active in almost 198 countries all over the world.

[one_half]

Pros

[tie_list type=”thumbup”]

- Very affordable fees

- Discount when trading BNB

- Credibility and reliability

- Buy crypto-assets with credit card

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- No support or live chat

- A bit complex for beginners

[/tie_list]

[/one_half_last]

Due to strict regulatory policies by the Chinese government on cryptocurrency, Binance has found a new way to stable itself, trying to slip from any type of regulatory body. Zhoa explained its motive on this issue.

“In response to China’s decisions, we are moving our IP’s from Hong Kong to an offshore location. So we are registered in multiple locations and we have people in multiple locations. That way we will never be affected by one regulatory body,”

For a verified account, you need to give the following information:

[tie_list type=”checklist”]

- First name

- Last name

- Gender

- Passport ID

- Country

- Passport photo

[/tie_list]

You can buy six different cryptocurrencies(XRP, BNB, LTC, BCH, ETH, and BTC) with the credit card such as Master Card and Visa Card with the assistance of Simplex charging almost 3.5% fee.

You can explore the markets of BNB, BTC and other alt-coins on the interface page.

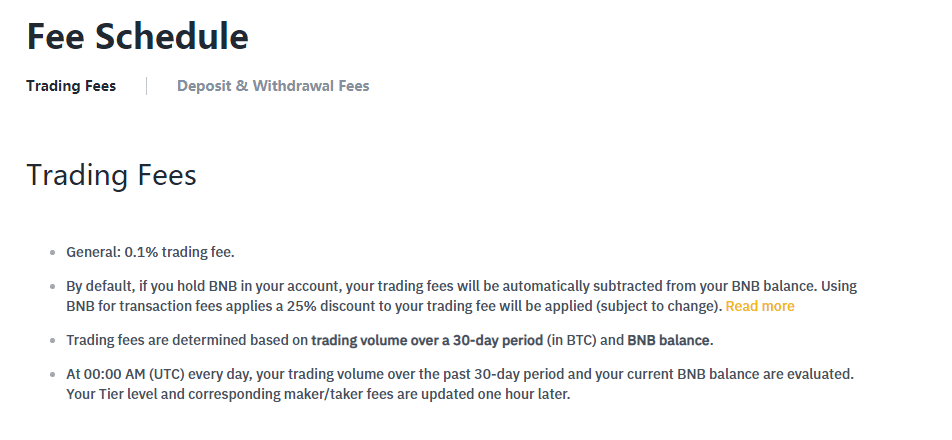

The normal fee rate of Binance exchange is 0.1% that is affordable gearing exchange on the top-level.

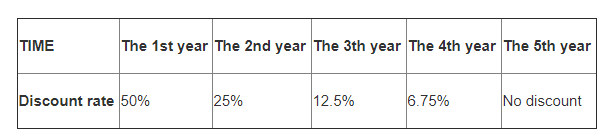

It gives striking discounts to ones who have BNB tokens in their wallets.

There is a limitation based on the verification of the users. Non-verified users can withdraw 2 BTC in one day while verified accounts can withdraw up to 100 BTC in one day.

The exchange is a top-rated platform for trading digital assets and can attract you with its low fee structure. Binance is somewhat complex for beginners due to its complex layout.

5. Poloniex

Poloniex is a US-based exchange, landed in the cryptocurrency world in 2014, with its headquarters in Delaware. Poloniex also offers margin trading and lending services to its users. There is good liquidity of altcoins on Poloniex which is a good thing about the exchange. It provides full security to its users with 2F verification. All trading on the exchange is in cryptocurrency and there is no role of fiat currency.

Poloniex has access to almost 199 countries:

China, Canada, France, Denmark, Iceland, United Kingdom, Malta, Indonesia, Mexico, Australia, Finland, Kuwait, Syria, Maldives, Russian Federation, Turkey, Sudan, Netherlands, Japan, Afghanistan, Egypt, Nigeria, Morocco, Congo, Austria, Hong Kong, Iran, Bangladesh, Philippines, Italy, Saudi Arabia, Ireland, Poland, Portugal, United Arab Emirates, New Zealand, Pakistan, Germany, India, Switzerland, Singapore, Spain, Hungary and many others.

[one_half]

Pros

[tie_list type=”thumbup”]

- Insurance coverage

- Store funds offline

- Margin and lending trading

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- No role of fiat currency

- No official mobile app

[/tie_list]

[/one_half_last]

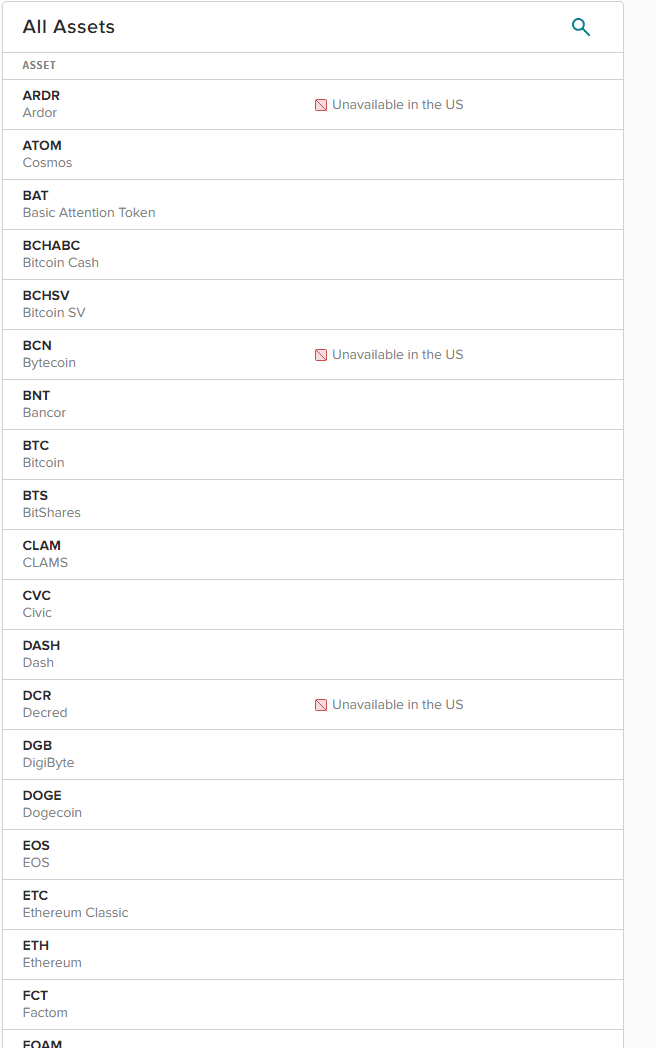

Poloniex listed almost 100 different digital assets on its platform for trading.

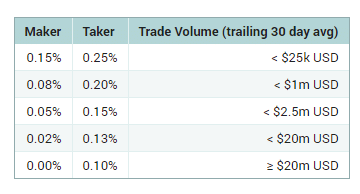

The fees range from 0.10% to 0.20% depending on the trading volume that can be zero for big investors who exceed 7.5 million as makers.

Maker fees are greater than the taker fees because makers help in increasing the liquidity which in turn gives a financial kick to the platform. Poloniex charges almost 15% to lending customers on interest gain.

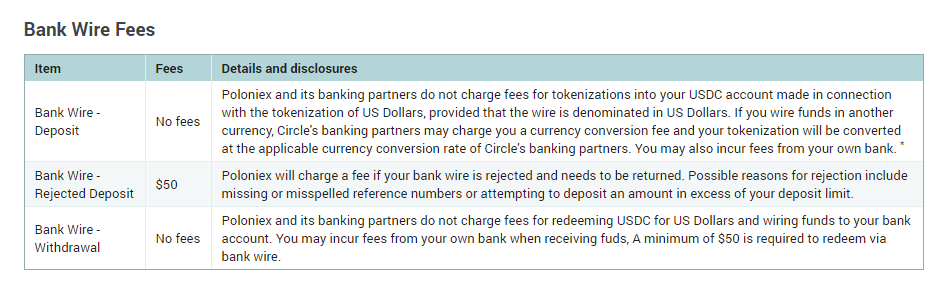

One who wants to deposits or withdraws through bank wire does not need to give any commission to exchange. But in case of rejection of bank wire, there is a fee of $50 to return.

Poloniex is one of the most leading platforms for trading of cryptocurrency with a variety of altcoins listed on the exchange. You can take benefits of margin trading and lending service.

6. Kucoin

Kucoin launched in 2017 but its development, technical tools and practice for making it secure started in 2011 that ensure us about its reliability and credibility. The interface of the exchange is very easy and simple for both beginners and professional investors and traders. Additionally, the technical tools and charts are also available that facilitate the process of trading.

The mobile app is also launched by Kucoin for bringing the trade of digital assets to your pockets; the app is available on both App store and Google play where you can view the charts, orders list and trading history.

[one_half]

Pros

[tie_list type=”thumbup”]

- Friendly interface

- Low fees

- Rewards and bonuses

- Mobile app

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- No role of fiat currency

- No margin trading

[/tie_list]

[/one_half_last]

Kucoin, the cryptocurrency trading platform, has access to 198 countries including:

Australia, Canada, Denmark, France, Mexico, Sri Lanka, Nepal, United Kingdom, Greece, Iceland, Malta ,Indonesia, Kenya, Sweden, Finland, Yemen, Colombia, Kuwait, Russian Federation, Turkey, Japan, Netherlands, Qatar, South Korea, Sudan, Malaysia, Afghanistan, Egypt, Congo, Taiwan, Morocco, Hong Kong, Philippines, Italy, Poland, Austria Ireland, Iran, Thailand, United Arab Emirates, Norway, Switzerland, South Africa and many others.

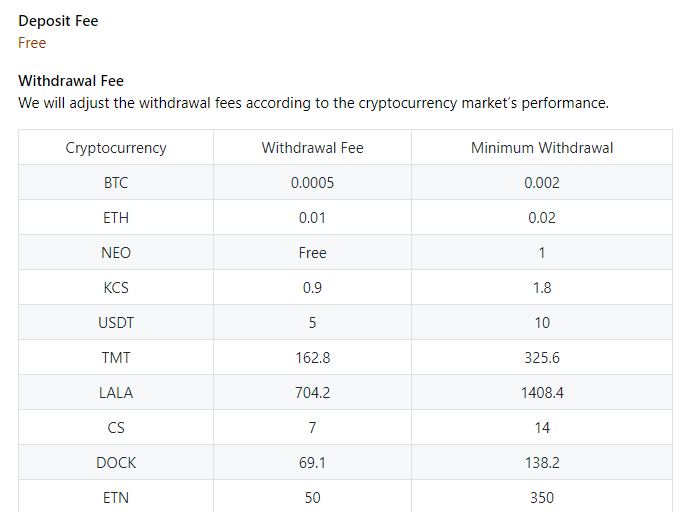

Kucoin is the cheapest platform when comes to the question of fee structure; charged only 0.1% on all normal maker and taker trades. There are no deposit fee deducted by the Kucoin but deducts varying fees on the time of withdraws.

The 90% of fee deduction giveaways as rewards and bonuses; while retains only 10% of total fees. Users can receive rewards by advertising platform, holding Kucoin shares and taking part in competitions and contests.

Kucoin is the best platform for new users due to the following reasons: friendly interface, no deep level verifications and its relatively low trading fee with free deposits.

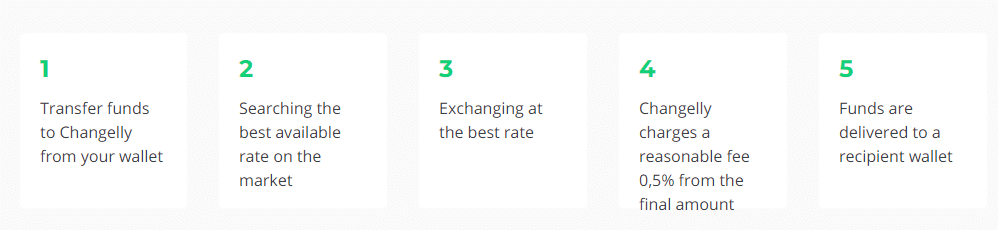

7. Changelly

The marked feature of the exchange is that it allows you to start trade at once without registration. The exchange allows you to trade cryptocurrency as an anonymous platform.

One can access the exchange through his or her smartphone using the Changelly Android App. Changelly also provides website widgets that can enable you to trade within the website without going to the official site of Changelly.

[one_half]

Pros

[tie_list type=”thumbup”]

- Friendly interface and simple to use

- Listed wide range of cryptocurrencies

- Average Fees(not very low)

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- High fees for purchasing cryptocurrency

- Sensitive security measures

[/tie_list]

[/one_half_last]

Changelly has partnered with Simplex; one can buy BTC with his credit/debit card using Simplex. Changelly is providing a variety of digital assets; there care almost 140 different cryptocurrencies listed on the platform.

Changelly is a worldwide platform for trading including the following countries:

Poland, Austria ,Ireland, Iran, Thailand, United Arab Emirates, Norway, Finland, Yemen, Colombia, Kuwait, Russian Federation, Indonesia, Kenya, Sweden, Turkey, Japan, Netherlands, Qatar Sudan, Malaysia, Afghanistan, Egypt, Congo, Nepal, United Kingdom, Greece, Iceland, Malta, Australia, Canada, Denmark, France, Mexico, Morocco, Hong Kong, Philippines, Italy, Switzerland, Taiwan, South Africa, Sri Lanka, South Korea and others.

The first transaction’s limit is $50 for users from the USA, Canada, and Australia while the limit is $100 for users from European and other countries.

When buying digital money from a credit card, the limitation on the transaction is different; the first transaction’s limit is $50 to $50,000, the daily limit is $20,000 and the monthly limit is $50,000.

The commission on trades of cryptocurrency is 0.05%, an average rate; neither too high nor too low.

Changelly is very simple to use with a variety of digital currencies listed on the platform that is enough to capture the attention of traders and investors. One does not need to verify his ID verification to start trading at the beginning. Overall, there are positive reviews on social sites about Changelly.

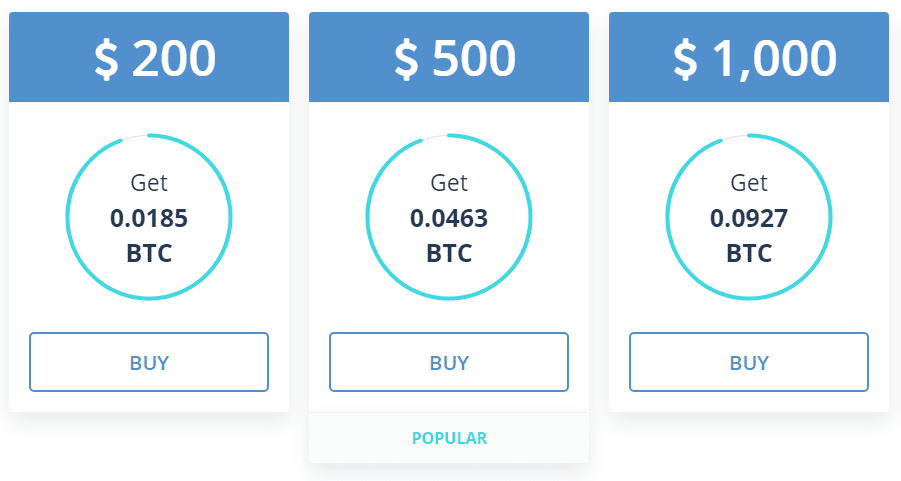

8. Coinmama

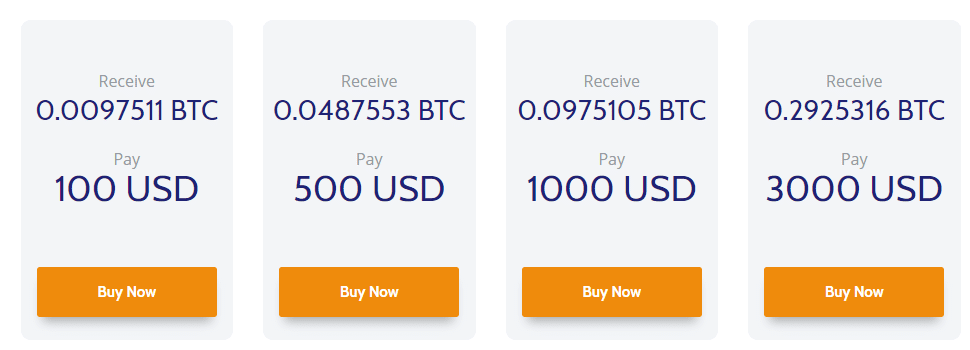

Coinmama is a globally recognized platform controlled by New Bit Ventures located in Israel. Coinmama would help those who are new to this digital kingdom as they are providing step by step how to buy cryptocurrency as well as selling the digital currency. You cannot trade on the platform as Coinmama is a just exchange.

There are almost 8 different types of coins are available for exchange and the exchange has access to nearly 200 countries that labeled it an international exchange.

[one_half]

Pros

[tie_list type=”thumbup”]

- Secure exchange

- Step by step guide available

- Simple and easy interface for beginners

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- High fees

- Limited crypto coins

[/tie_list]

[/one_half_last]

One can easily buy 8 different types of cryptocurrencies that include Bitcoin, Ethereum, Ripple, Litecoin, Bitcoin Cash, Cardano, Qtum, and Ethereum classic.

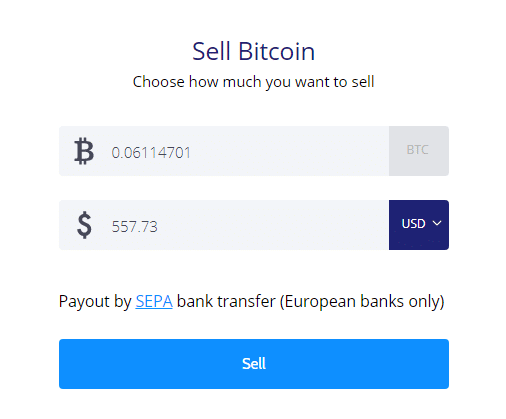

You can sell only Bitcoin through this platform; there is no option for selling digital currency except bitcoin.

When Coinmama came into existence, they accepted deposits by Western union, later they added a credit card or debit card as a payment method and removed the previous option. But now they added the Bank transfer as payment method to buy cryptocurrency with limits up to $12,000.

There are three options are available for transactions and respectively different fees for these. There is 5% commission on transaction through credit card. There is no fee if you deposit through SEPA bank transfer and similarly 0% commission on SWIFT bank transfer above 1000 USD.

Coinmama is not suitable for those who are intrigued by trading as it is not a trading platform. It is a secure and reliable exchange for buying and selling BTC, although there are limited digital coins available.

9. Ternion Exchange

Ternion exchange is a licensed, regulated, and hybrid crypto exchange based in Estonia that offers crypto-to-fiat, fiat-to-crypto, and crypto-to-crypto trading. This full-fledged crypto-fiat exchange is formed by a group of companies.

This reliable crypto exchange offers the facility of Exchange trading and Margin trading. It provides traders with a powerful trading environment and best trading conditions for the margin and deliverable trading of cryptocurrencies and fiat currencies. In short, it is a comprehensive trading solution for traders.

10. Kraken

Karaken is the exchange as well as the trading platform of cryptocurrency founded by Jesse Powell in 2011, with headquarters in San Francisco, California. Kraken is offering margin trading as well as OTC (Over the Counter) services to its users. The dark pool, an order book, is established to avoid the unnatural price movement by hiding the particular’s order book from other traders.

Karaken has access all over the world except the following countries:

[tie_list type=”cons”]

- North Korea

- Tajikistan

- Afghanistan

- Iran

- Japan

- Cuba

- Iraq

[/tie_list]

[one_half]

Pros

[tie_list type=”thumbup”]

- Have dark pool

- Margin trading

- Fiat trading

- Good support

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- High fees for low volume trading

- Complex interface for beginners

[/tie_list]

[/one_half_last]

Three types of fiat currencies are functional on the Karaken:

[tie_list type=”lightbulb”]

- US dollars (USD)

- Euros (EUR)

- Canadian dollars (CAD)]

[/tie_list]

There are nearly 20 different digital currencies are available at the platform:

Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Ethereum Classic (ETC), Bitcoin Cash (BCH), Cardano (ADA), Zcash (ZEC), Litecoin (LTC), Stellar Lumens (XLM), Dogecoin (DOGE), Melon (MLN), Iconomi (ICN), Dash (DASH), EOS (EOS), Tether (USDT), Cosmos (ATOM), Gnosis (GNO), ) Monero (XMR), Augur (REP), Qtum (QTUM) and Tezos (XTZ).

There are three types of trading pairs are available on the platform:

[tie_list type=”checklist”]

- Fiat-to-Fiat Pairs

- Fiat-to-Crypto pairs

- Margin Pairs

[/tie_list]

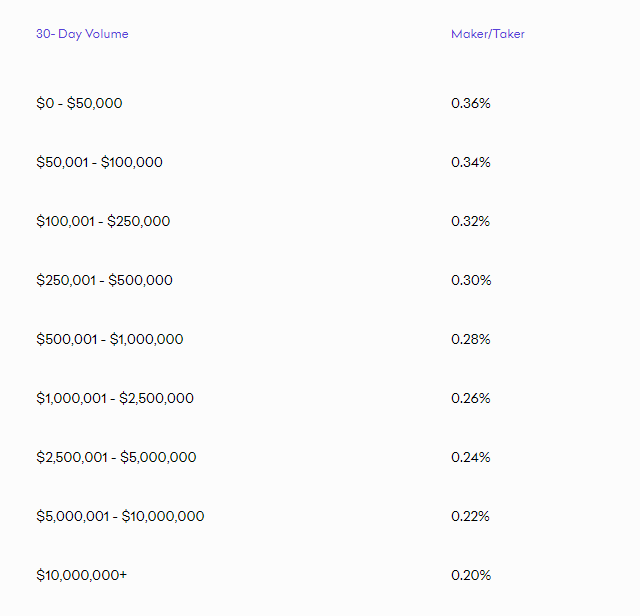

The fees on trading depend on the volume of trading; the maker fees range from 0.00% to 0.16% while the taker fees range from 0.10% to 0.26%.

On the other hand, the dark pool fees range from 0.20% to 0.36%.

There are remarkable features of Kraken unlike other platforms such as dark pool, spot trading, fiat trading, and cryptocurrency trading. The fees are relatively high for large volume trading means it is not very good for those who want to start from low volume trading.

11. Bitfinex

Bitfinex was founded by iFinex inc in 2012 and established its headquarters in Hong Kong. It was initially started as a lending platform for BTC but later on, grows rapidly to its latest version today.

Bitfinex has improved its security system due to bad experiences in the past. The system was hacked the first time in 2015 and loosed almost 1500 BTC. The second attack happened on April 2016 and 120,000 BTC stolen from the platform, second theft attack in history.

[one_half]

Pros

[tie_list type=”thumbup”]

- Mobile app available

- Good for professional traders

- Advanced trading tools

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- Security problems

- Complex for newcomers

[/tie_list]

[/one_half_last]

Bitfinex accepts deposits in four following fiat currencies:

[tie_list type=”checklist”]

- USD

- EUR

- GBP

- JPY

[/tie_list]

The following cryptocurrencies are listed on the Bitfinex:

BTC, BCH, BTG, TNB, RLC, RCN, BOX, GOT, TKN, MIOTA, NEO, OMG, MANA, SPANK, REP, XRP, BAT, ZRX, FUN, QASH, YOYO, MITH, DATA, EDO, EOS, ETC, TRX, GNT, AVT, AID, SNGLS, SNT, DASH, ETH, LTC, SAN, USDT, QTUM, ETP, XTZ, CNN, UTN, ELF, and XMR.

Bitfinex is a worldwide platform but doesn’t have access to the following countries:

[tie_list type=”cons”]

- United States of America

- Bangladesh

- Bolivia

- Kyrgyzstan

- Ecuador

[/tie_list]

The exchange offers two methods to deposits funds; one is through cryptocurrency and the other one is Wire transfer.

The commission on trading digital assets is based on the maker-taker pattern; the maker fees range from 0% to 0.1% while taker fees range from 0.1% to 0.2%.

The rate for deposits and withdraws through Wire transfer is 0.1$ while rate for the transactions through cryptocurrency may vary.

The platform had many serious problems in the past regarding its security. It is recommended that, do your research before putting your money. On the other hand, there are a lot of trading tools that may assist in better trading.

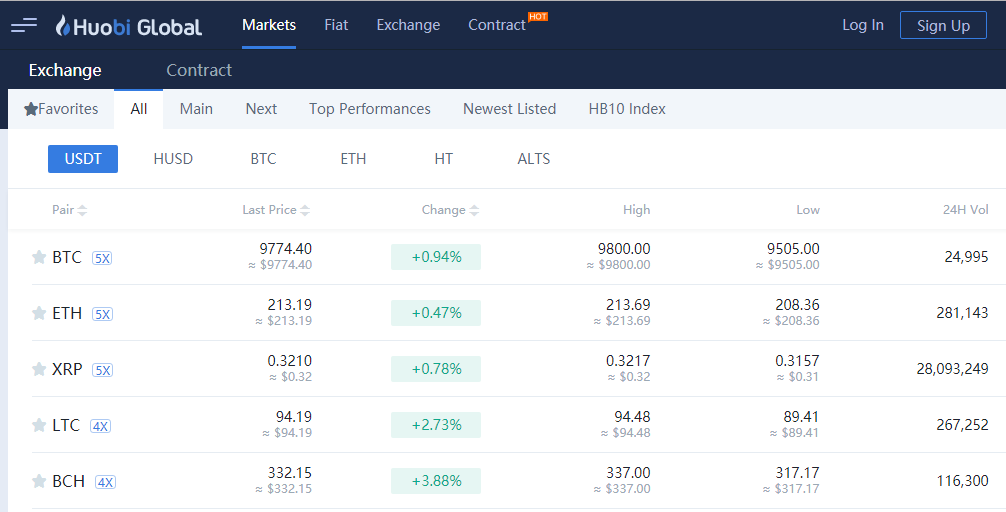

12. Huobi

Huobi, an exchange as well as a trading platform, was founded by Leon Li in 2013. Initially, it was developed for China, but later on, it became an international platform for trading. Huobi was once a top exchange of the world with a turnover of 1.2 trillion dollars comprising almost 50% of market share.

Its downfall started when the Chinese government banned the cryptocurrency in the country but it tried its best to stabilize. It was hacked in the past but funds were not stolen. With bad experiences in the past, it is still one of the top trading platforms of the world.

Huobi Global doesn’t have access to US users; for US customers, they develop another site based in California.

[one_half]

Pros

[tie_list type=”thumbup”]

- Big list of digital assets

- OTC desk

- Advance tools for charts

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- A bit difficult for newcomers

- US users don’t have access to Huobi Global

[/tie_list]

[/one_half_last]

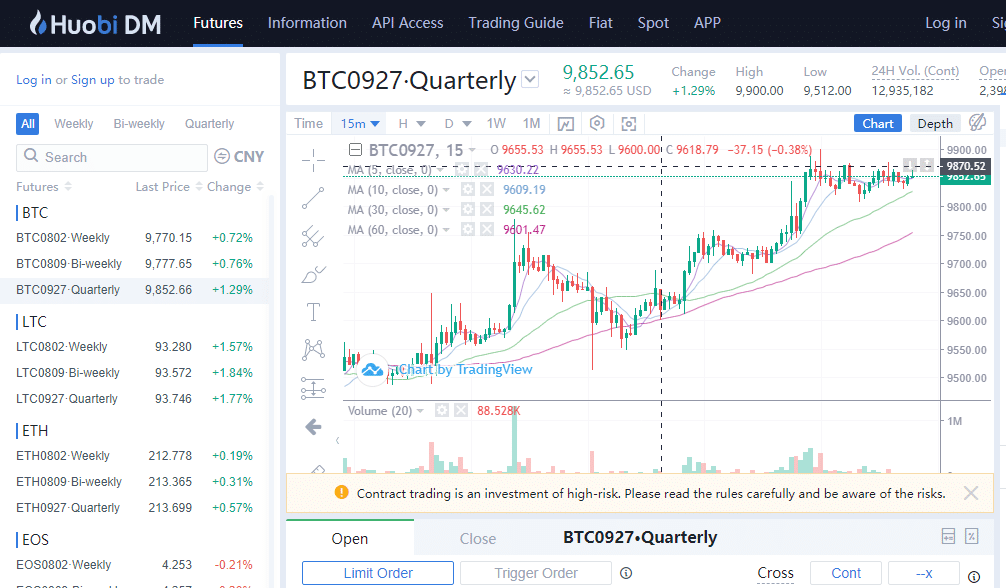

The margin trading is another feature provided by the exchange to its customers to earn more income. The OTC desk is available for institutional and professional traders but this service is not active in some following states and countries:

China, United States, North Korea, Montenegro, Bangladesh, Sudan, Taiwan, Germany, Iran, Ecuador, Lebanon, Iraq, Libya, Cuba, Syria, and Tunisia.

Huobi is a global exchange and trading site for crypto assets. There are almost 218 different crypto assets listed on the platform and exchange has access to nearly 200 countries.

Huobi is striving to make the process of trading easy and simple. For this, the mobile app is launched to access the platform to its user’s pockets. Additionally, advance charts and tools from the Trading view also present to facilitate the process of trading.

There is no commission at all for deposits and withdraws of digital assets. However, the commission for both makers and takers is 0.2%.

There is confusion between the two websites of Huobi. They have developed a new exchange, especially for US users due to the strong laws of the US government while Huobi Global is designed for non-US users. The charts attached to assist the traders in trading practices.

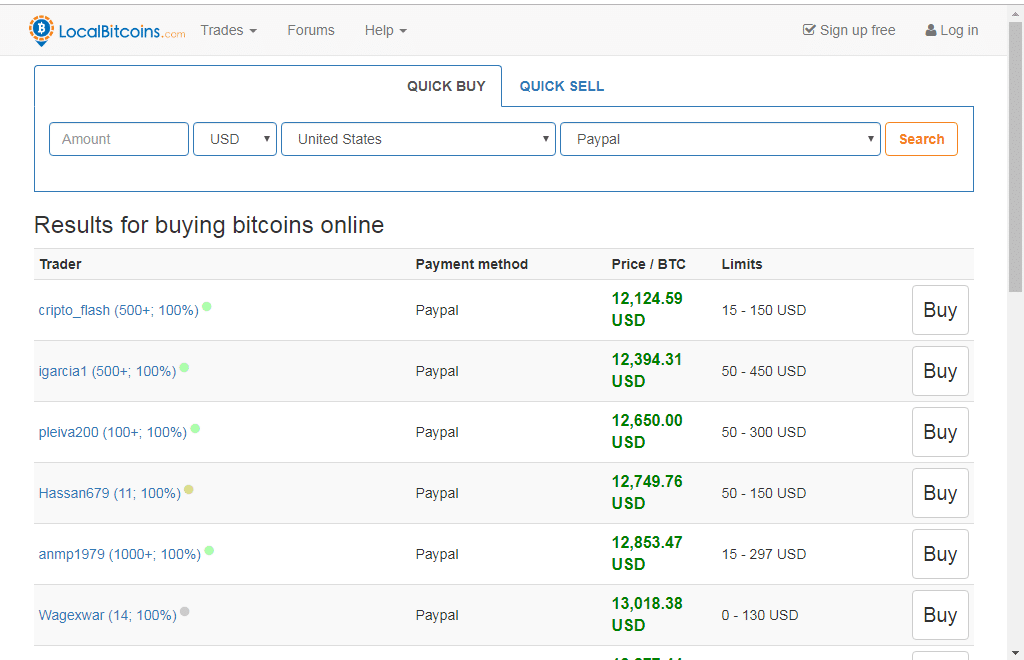

13. LocalBitcoins

LocalBitcoins started its journey as a digital assets exchange in 2012 and headquartered in Finland. As the name suggests, LocalBitcoins track the local position of buyers and sellers to make the deal with each other. It serves to connect the traders and investors within a particular geographical region.

LocalBitcoins serves more than 200 countries but there are some states, who don’t have access to LocalBitcoins due to regulatory restrictions or laws implemented by the governments:

[tie_list type=”cons”]

- United States

- China

- North Korea

- Indonesia

- Syria

[/tie_list]

[one_half]

Pros

[tie_list type=”thumbup”]

- Connect traders in particular region

- Very low fees

- Wide range of payment methods

- Strong security measures

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- Doesn’t have access to US users

- Poor support

- No mobile app

[/tie_list]

[/one_half_last]

Transactions are made through payments that have peer to peer transactions system. Following payment methods are working for transactions on the platform:

[tie_list type=”starlist”]

- PayPal

- Webmoney

- Cash by mail

- Wire transfer

- Cash

- Mobile money (selected countries)

- Western Union

- SWIFT

- Online wallet

- Altcoins (Ripple, Litecoin and Ethereum)

- Moneygram

[/tie_list]

Trading of bitcoins (selling and buying) is free of cost while users who made advertisements for their bitcoins are charged 1%. The commission on transactions from the wallet of one user to another user is also free of cost. Moreover, there is no limitation on the trading volume of bitcoins.

On the time of transactions of BTC, the following security measures are kept in view:

[tie_list type=”lightbulb”]

- IP Address Confirmation

- 2FA (2-factor authentication)

- Escrow Protection

- KYC (Know your customer)

[/tie_list]

When you want to purchase bitcoins, you should check the following features about the seller’s profile:

[tie_list type=”checklist”]

- Feedback score of the seller (should be at least 100%)

- Number of verifications

- Feedback comments

- Number of past confirmed trades

- Volume of trade

[/tie_list]

If someone wants to buy or sell bitcoins in his or her area then it is the best method. Adding more, the fees are very competitive in comparison to other exchanges.

Read full review about localbitcoins : LocalBitcoins Review

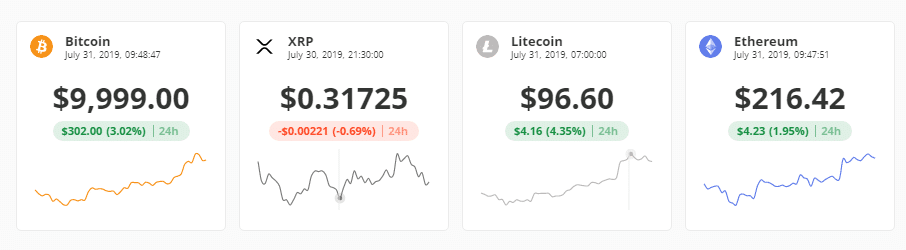

14. Bitstamp

Bitstamp was founded in 2011, one of the oldest trading platform, by Damijan Merlak and Nejc Kodrič as a bitcoin trading site. It is a versatile platform for institutional and professional traders. The fiat currencies that are functioning on-site are US Dollars (USD) and the EURO (EUR).

There are following four payment methods that are working actively:

- Credit/Debit Card

- Cryptocurrency (BTC, XRP, LTC, BCH, ETH)

- SEPA

- International Wire Transfer

[one_half]

Pros

[tie_list type=”thumbup”]

- Comparatively low fees

- Mobile app ready

- Good for European users

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- Limited digital currencies

- No margin trading

- Complaints of poor support

[/tie_list]

[/one_half_last]

The digital assets listed on the exchange include Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Bitcoin Cash (BCH) and Litecoin (LTC).

Four different types of orders that are available for traders on Bitstamp: stop, market, limit, and instant.

Bitstamp has access to the following countries along with European countries:

South Africa, Brunei, Saudi Arabia, Japan, Chile, South Korea, Turkey, Switzerland, Gibraltar, Martinique, New Caledonia, Australia, New Zealand, Jamaica, Lebanon, Paraguay, Ecuador, Dominican Republic, Bahrain, Monaco, Norway, Cayman Islands, Tobago, French Polynesia, San Marino, Isle of Man, India ,Moldova, Qatar, Hong Kong, Peru, Jordan, Trinidad, China, Iceland, Liechtenstein, Åland Islands, Dominica, Réunion, Montenegro, Barbados, Sint Maarten, Madagascar, Singapore, Kuwait, Faroe Islands, Serbia, Mozambique, Taiwan, Curaçao, Guadeloupe, Greenland, Israel, Puerto Rico, Andorra, Bahamas and Brazil.

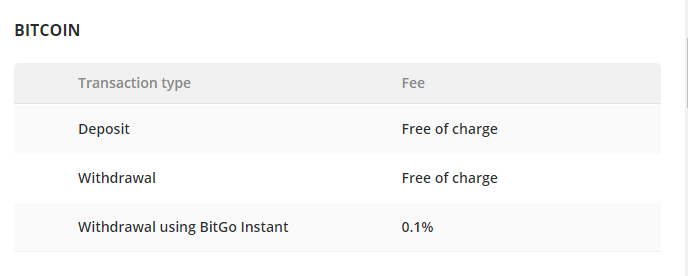

Trading fees on Bistamp may vary from 0.10% to 0.25% based on the volume of trading. This trading site is cheaper than most of the exchanges in terms of deposits and withdraws. The deposits processing through SEPA is free of cost but charges 0.90 EUR while withdrawing using SEPA.

Bitcoin’s deposits and withdraws are free of charge. Similarly, the deposits and withdraws through altcoins are also free.

Bitstamp is a good exchange for users from European states because the fees on deposits and withdraws through SEPA are very low. All in all, it is a competitive trading platform for trading BTC.

15. CEX.io

CEX.io came into existence as a bitcoin exchange as well as a cloud mining platform in 2013. But in 2015, the cloud mining system closed and started its journey as an exchange for digital currencies. The exchange is secured with KYC (know your customer), AML (anti-money laundering) and also registered with FINCEN.

The distinguishing feature of CEX.io is that it offers brokerage service to new customers. The brokerage service allows placing FOK (fill or kill) orders that are processed quickly than normal placing your orders. But the rates of these types of orders are somewhat expensive than the traditional type of orders and this difference of rate may reach up to 7%.

[one_half]

Pros

[tie_list type=”thumbup”]

- Brokerage service

- Good support

- Mobile app

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- High fees

- Limited pairs

[/tie_list]

[/one_half_last]

Through brokerage service, you can buy the following digital currencies: Bitcoin (BTC), Ripple (XRP), Dash (DASH), Zcash (ZEC), Bitcoin Cash (BCH), Ethereum (ETH), Bitcoin Gold (BTG) and Stellar (XLM).

The margin trading is only available for Ethereum (ETH) and BTC. CEX.io offers margin trading with leverage up to 10x on Ethereum (ETH) and BTC.

Three payment methods are available to deposit and withdraw funds on CEX.io:

[tie_list type=”checklist”]

- Credit card (Visa, Master card)

- Bank transfer (SEPA, SWIFT)

- Cryptocurrency

[/tie_list]

Fiat currencies accepted by the exchange are as follows:

[tie_list type=”lightbulb”]

- EUR

- USD

- RUB

- GBP

[/tie_list]

The rates are comparatively higher than other exchanges as CEX.io may charges up to 7% from fiat currency for service. The rates on deposits and withdraws are based on fiat currencies. The deposits through bank wire or bank transfer are free of cost while charges up to 3% on using Credit or Debit card.

The margin trading is recommended only for professional traders. The interface is simple and step by step guide is available for newcomers. However, there are limited crypto-assets that are listed for trading but it is a good exchange for trading BTC.

16. Gemini

Gemini is founded by Winklevoss twins in 2015 as an exchange for Bitcoin and Ethereum. It has launched its mobile application to make the process of trading easy for its users. Another striking feature of this exchange is that it stores most of the Ethereum and bitcoins in offline wallet making it less risky and assist in maintaining the high liquidity.

Gemini introduced its Gemini-dollar to create a powerful bridge between the traditional banking systems and the crypto world.

The negative point about Gemini is its reach to the limited number of countries; we are unable to claim that it is a global platform. Gemini is active in 29 states of the US and other following countries:

- Hong Kong

- South Korea

- U.K

- Canada Singapore

[one_half]

Pros

[tie_list type=”thumbup”]

- Secure and reliable

- Mobile app

- Free deposits and withdraws

[/tie_list]

[/one_half][one_half_last]

Cons

[tie_list type=”thumbdown”]

- Limited cryptocurrencies

- No margin trading

- Access to small numbers of countries

[/tie_list]

[/one_half_last]

There are limited numbers of digital currencies listed on the exchange which are as follows:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Litecoin

- Zcash

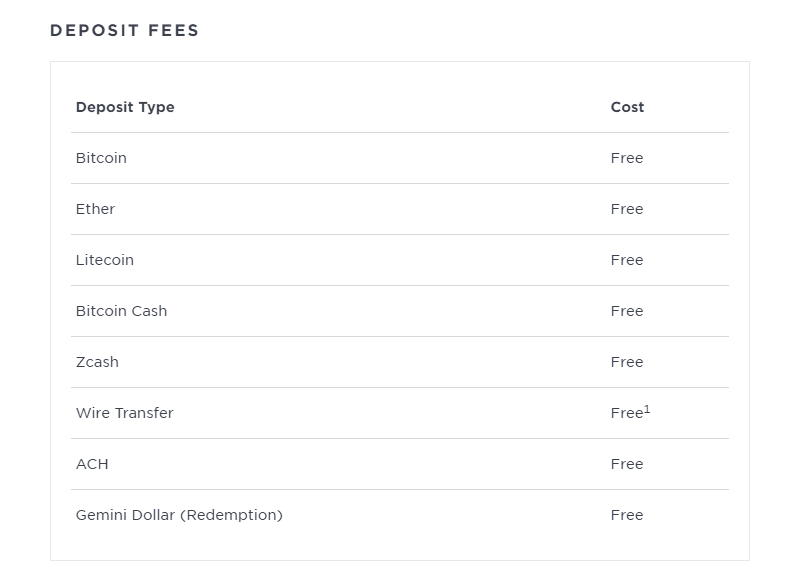

There are limited numbers of payment methods accepted by Gemini:

[tie_list type=”checklist”]

- Wire transfer

- ACH (only in the US)

- Cryptocurrencies (Bitcoin and Ethereum)

[/tie_list]

Four different types of orders can be made on Gemini are as follows:

[tie_list type=”lightbulb”]

- Market orders

- Limit orders

- Immediate limit orders

- Maker limit orders

[/tie_list]

The trading fees for both buying and selling digital assets are based on the volume of trading and may reach up to 0.25%.

There are no fees on deposits and withdraws but there is a limit on withdraws. You can make 30 withdraws free of cost but will pay when exceeding this limit.

The exchange is well designed for beginners as well as experienced traders and investors. It is the best platform for trading Ethereum and bitcoin as it is a secure and reliable exchange.

Final Words :

These exchanges are listed based on reviews on social sites and popularity in the markets of digital money. It is not based on any interest or gain but personal advice to guide you in the right direction without any risk or scamming issues.

If you have a negative or positive experience with any one of these platforms, please share with us in the comment box.

[divider style=”solid” top=”20″ bottom=”20″]

Want to buy bitcoin with credit card? we have a comprehensive guide on 9 Best ways to buy bitcoin with credit card

Buy Bitcoin with credit card Step by Step Guide

[divider style=”solid” top=”20″ bottom=”20″]

Want to buy bitcoin with Paypal? we have a detailed guide on 7 Best ways to buy bitcoin with paypal with step by step guide

Buy Bitcoin with paypal Step by Step Guide

[divider style=”solid” top=”20″ bottom=”20″]

Want to Know How to Earn Bitcoins 2019? we have a Complete guide on 15 Best ways to Earn Free bitcoin

[divider style=”solid” top=”20″ bottom=”20″]

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.