When Jerome Powell testified before Congress yesterday, it was expected that the Bitcoin price will experience a correction. However, Tesla founder had other ideas as he tweeted:

Elon Musk tweet. Source: Twitter

Musk announced in the early hours of today that potential buyers can now for their electric vehicles using bitcoin. He further said that the company need not use a 3rd-party payment service because tesla utilizes bitcoin nodes directly through internal and open-source software. The billionaire entrepreneur confirmed that payments for Tesla with Bitcoin won’t be converted to paper money.

This monumental revelation by Mr. Musk comes about a month after the company announced through its securities filings that it owns about $1.6 billion BTC worth. Part of these filings also showed that the company had bought it since January of last year when the king coin was still less than $40K in price. Since that announcement became public knowledge, BTC/USD has risen by about 61%.

BTC Price Surge

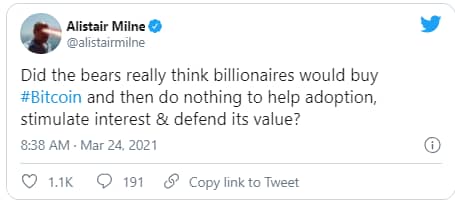

Musk’s announcement gives hope of a Bitcoin rally for the rest of the year. Popular swede and crypto YouTuber said that he is convinced that bitcoin will remain bullish for the remaining part of this year. Another crypto enthusiast, Alistair Milne tweeted about the possibility of a rally saying, billionaires would do everything in their power to create interest and defend the value of their purchases.

Alistair Milne tweet. Source: Twitter

Almost immediately after the billionaire’s tweet, there was a flash of a green candle on the BTC chart. The king coin rose by over one percent to exceed $55.6k (- an intra-day high) and cancel out the effect of Mr. Powell’s testimony.

Bitcoin rallies after Elon’s tweet. Source: BTC/USD on TradingView.com

During his congressional testimony, Mr. Jerome had said the vaccine rollout should cause a robust economic recovery in America but that he doesn’t foresee an increase in inflation due to the president’s almost $2 million stimulus package. He then said that even if inflation becomes out of control, the fed is equipped enough to combat it.

BTC bulls have previously forecasted a reduction in the U.S. dollar’s purchasing power and a rise in inflation due to the trillions of dollars being pumped into the economy for the coronavirus stimulus package and the fed’s quantitative easing program. During Mr. Powell’s testimony, the stocks and bitcoin declined while the greenback surged. A rising economy must prevent selling the U.S. dollar for riskier assets.

The Spending Program That Would Be Beneficial to BTC

In the meantime, it is becoming more than likely that there would be a devaluation of the dollar because the current administration intends to roll out a $3 trillion government spending package to enhance education, childcare, clean energy, and infrastructure. This move will be beneficial to bitcoin because of its scarce and anti-inflation nature. Hence, most crypto analysts are predicting that there would be more companies mirroring tesla’s initiative to invest in bitcoin and other crypto-assets.

Vijay Boyaparti, the author of the bullish case for bitcoin, states that “it would be foolish for Facebook, Google, Apple, and Microsoft not to invest at least 2% of their treasury assets in bitcoins.”. He noted that these companies’ hundreds of billions held in low yield government bonds are subject to the heat of U.S. Inflation.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.