It seems it is a week for Bitcoin bulls as the price of the leading cryptocurrency is about to reach $40K as of this writing. After a steady movement over the weekend, Bitcoin surged sharply overnight Sunday, and right now, the BTC/USD is about to reach a new multi-month peak price level.

Bitcoin would likely reach a new multi-week peak since most bears have liquidated their positions and fundamentals remain favorable. There are a few factors Tokenhell considers to be important price action determinants as the week proceeds:

Bitcoin Gains Almost 16%

All cryptocurrency traders and analysts concur that spot price action is the cause of Bitcoin’s almost 16% gains in the past 24 hours. Though it is yet to turn the $40K price into resistance, it hasn’t reached these levels in more than 6 weeks now. Hence, a bullish run might be on the horizon.

The rise started slowly with Jack Dorsey’s “B-word conference” during which the Twitter founder and Tesla car founder, Elon Musk, were full of praise for Bitcoin. However, there were still no clear indications of any breakout probably because analysts weren’t convinced that the market is about to embark on a new bullish run when it seems it’s about to plunge further.

Surprisingly, Micheal van de Poppe, a leading crypto analyst, and trader, said he anticipates a Bitcoin impulse move. He even predicted that altcoins will toe the line of Bitcoin too.

BTC/USD 1-hour chart. Source: TradingView

Beijing Crypto Crackdown Has No Significant Effect On Stocks

Price action becomes important again as there is a renewed focus on the comparison between Bitcoin and the traditional markets. Despite the recent China crackdown on Bitcoin, equities keep struggling, while Bitcoin keeps rising.

While the U.S. Dollar currency index (DXY) will likely reach local highs of about 95, it will still decline. Its decline will allow some breathing room for Bitcoin. However, the DXY will continue to pressure the virtual asset market till it starts declining.

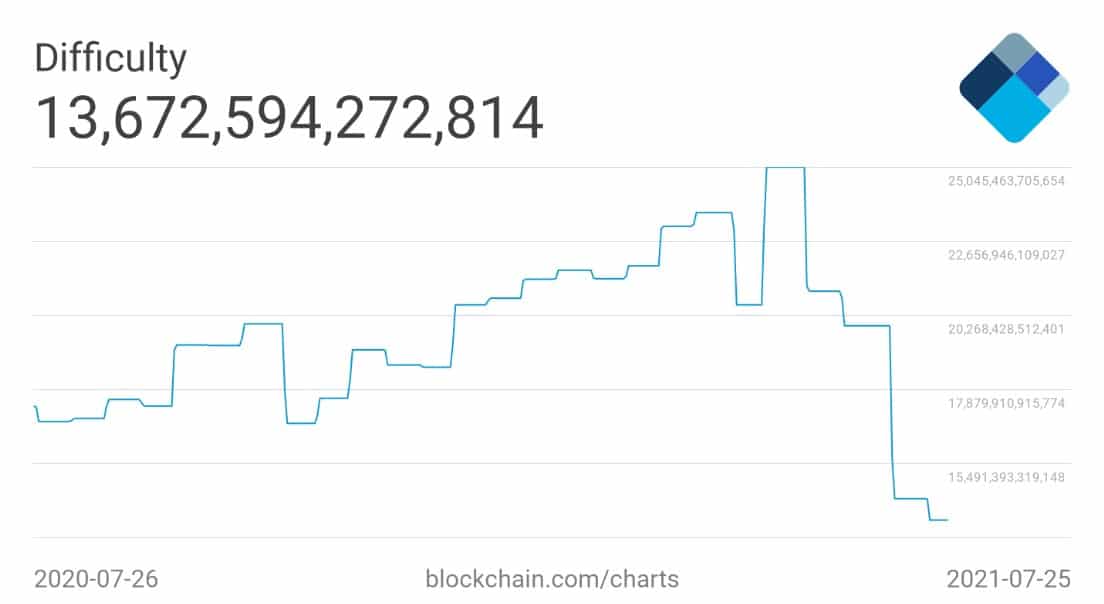

Positive Signs From Bitcoin Hash Rate

Before the price recovery which started last week, Bitcoin fundamentals was already recovering. One of these fundamentals is the Bitcoin hash rate which is now about 100 exahashes per second (EH/s). Gains have been short and quick when the hash rate was less than 100 EH/s.

Also, the Bitcoin difficulty is predicted to reach about 3.8% when the next readjustment is completed in the next five days. If the Bitcoin difficulty reaches this percentage, it will be a first since May and an excellent sign that the consequences of the mining rout since May is no longer significant.

1-year blockchain difficulty chart. Source: Blockchain

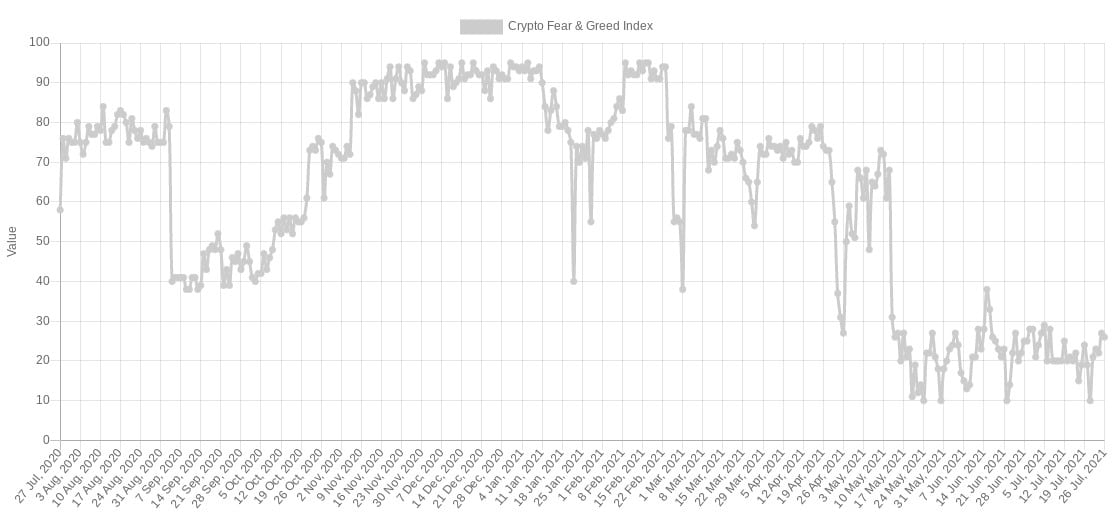

Market Mood Still On “Fear” Mode

The current crypto fear & greed index of 27/100 shows that the market mood remains in “fear” mode. This current index indicates that a Bitcoin price rise won’t spur any investor selling spree. It is noteworthy that Bitcoin fear and greed remained at almost 40/100 for more than eight weeks – its longest streak ever.

1-year crypto fear & greed index. Source: Alternative

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.