On Wednesday, bankrupt crypto lending firm Celsius revealed that it had selected digital asset investment company Novawulf to help end its bankruptcy case. The Celsius debtors proposed the reorganization and sale plan, which the firm’s official creditors committee fully supported.

The plan involves the creation of a new firm that NovaWulf would manage and also contribute $50 million to the new project. In a statement, Celsius said that it is certain that Novawulf will provide the best way to distribute its liquid crypto assets and use the new venture to increase the value of the illiquid assets.

How Liquid Crypto Will be Distributed to Creditors

Celsius reports that about 80% of its customers would be able to recover over 75% of their claims in liquid digital assets. Holders of the crypto lender’s Earn account with claims below $5,000 would be placed in a ‘convenience class’ that enables them to receive money through a one-off distribution of Ethereum, USDC, and Bitcoin.

Creditors with claims above $5,000 can reduce them to the figure to join the class. Further, Celsius Earn creditors will be the owners of the new firm, and a token to be traded on the Provenance blockchain will represent ownership.

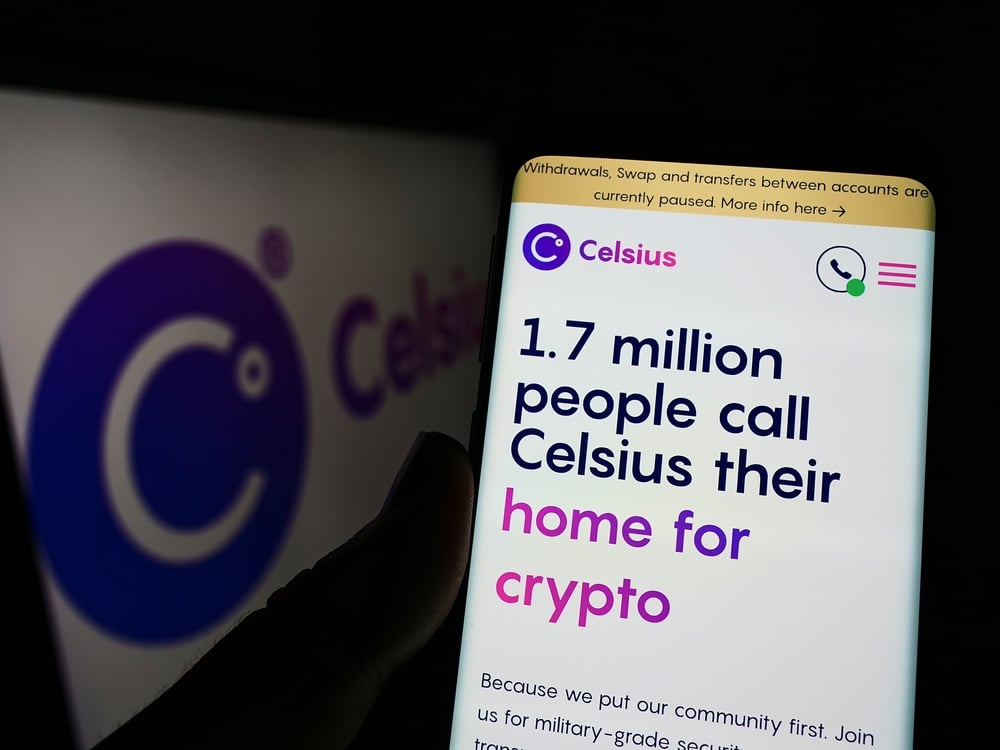

Celsius filed for bankruptcy protection last July, with over 250,000 users holding $90 or more in their accounts. However, the users could not access their funds as the crypto lender had suspended withdrawals due to what it called ‘harsh market conditions’ a month before filing for bankruptcy.

Other Bankrupt Crypto Firms Could Adopt Celsius Plan

If actualized, Celsius’ proposed plan can help other crypto firms that have filed for bankruptcy settle with their creditors. Several firms have encountered financial problems since the crypto winter began. In July 2022, Voyager filed for bankruptcy after it revealed that its $650 million was stuck in Three Arrows Capital, a collapsed crypto hedge fund.

Elsewhere, crypto lender BlockFi filed for bankruptcy last November following the collapse of FTX. Further, in late January 2023, Genesis, a firm owned by Digital Currency Group, also filed for bankruptcy, citing liquidity problems due to exposure to FTX and Three Arrows Capital.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.