Ethereum network activity has increased many folds due to the rising interest in decentralized finance (DeFi). New data shows that Ethereum miners collected eight times more fees than Bitcoin miners in September alone.

Crypto investor Lan Lee finds out that there was a tough competition between the world’s top two blockchains last month, but Ethereum took leading position by making eight times more revenues in mining fees.

Ethereum Miners Collected $166 Million

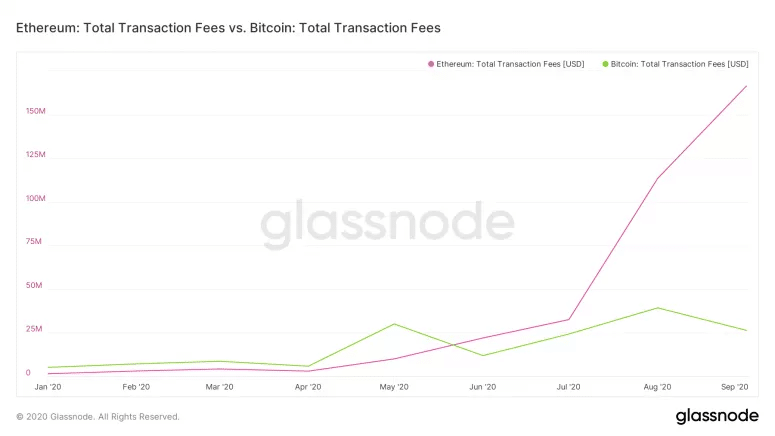

He has quoted data from blockchain analytics firm Glassnode which shows that Bitcoin miners collected only $26 million from mining fees as compared to $166 million by Ethereum miners. According to Lee, Ethereum’s “miner fee revenues past Bitcoin’s due to DeFi.”

What’s driving Ethereum activity high? It is obvious that DeFi is pushing Ethereum activity high. Over recent months, many DeFi projects have joined Ethereum.

The trading volume of decentralized exchanges is also making new records. DEX is another thing that has also pushed activity high over Ethereum blockchain as the trading volume over decentralized exchanges has reached billions.

Many crypto analysts are having a belief that growth over the Ethereum network is a fundamental factor as it could drive price value upward.

Buterin Recommends Ethereum for Payments

Ethereum co-founder Vitalik Buterin recently asked people to support Ethereum payments. Supporting network payments will support ERC20 tokens as a result. These tokens include Uniswap (UNI), Maker (MKR), and Wrapped BTC (WBTC). He endorsed people to Ethereum for payments as it is the second-largest cryptocurrency by market volume.

However, users of the network have an issue of fees that are higher than any other blockchain. According to the company, the problem of high fees can be solved with a new update called ETH2.0. ETH2.0 is scheduled to roll out this year.

Currently, the Ethereum coin is trading at $347 after surging by 2.88% in the past 24-hours. Yesterday, it went down following Bitcoin due to two bad news in the crypto space. First, the US regulator had charged three owners of BitMEX as they were running an unregulated Bitcoin derivatives exchange. Second, Trump had tested positive for COVID-19 and after that, the global market fell down.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.