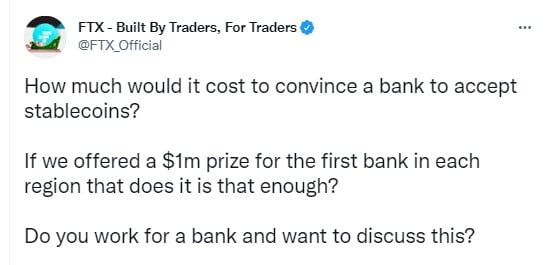

FTX exchange wants banks to accept stablecoins to enhance the wider adoption of stablecoins. Recently, the exchange polled its Twitter audience to find out whether banks won’t mind a $1m prize money to start accepting stablecoins.

The Stablecoin Adoption Challenge

Even though US financial regulators are also stablecoins as part of other virtual assets, it doesn’t mean banks have been forbidden from accepting it. However, the banks may have issues accepting stablecoins or digital currencies since they already support national digital currencies. But crypto exchanges remain resolute in their desire to further the cause of broader adoption of cryptocurrency.

FTX claims that it is seeking bank collaborations to make it possible for deposits and withdrawals to be instant. According to the exchange, many users find it challenging to make funds transactions between the banks and the exchange, with most transactions taking many days before completion. FTX’s decision might not be unconnected with the substantial increase in its userbase and transaction volume, as disclosed in its last quarterly report.

FTX’s Poll Tweet. Source: Twitter

Two months ago, the exchange sought fresh funds from venture capitalists to expand its business operations. The firm generated nearly $425m from the series funding. Some notable investors included Lightspeed venture partners and Sequoia capital in this funding round.

As of this writing, the FTX exchange ranks third in the top crypto exchanges globally. Its growth and popularity are linked with a TV ad featuring NFL legend Tom Brady and collaborations with many top basketball teams such as the Golden State Warriors, Miami Heat, and other sports teams.

Highly Leveraged Trade Positions Are Wrong – FTX Boss

FTX boss, Sam Bankman-Fried, has opined that platforms offering high leverage for trading positions are killing the business and portraying the crypto industry in a bad light.

Bankman-fried aired his opinions at a recent interview with the theblockcrypto. He further said that traders utilizing such leverages would need to have colossal collateral to support such positions and understand the asset’s volatility and previous similar moves by the asset.

The FTX boss also claimed that the digital asset sector needs enhanced scalability before it can be taken with the seriousness it deserves. “Even though it is a good thing that blockchains are scaling (especially with Solana’s 50k TPS), it is nowhere near enough. Industrial-scale scalability requires a minimum of one million TPS. So, no blockchain can claim to be fast right now until they conduct at least a million TPS,” he said.

Scaling The Blockchains

Bankman-fried claimed that the accomplishments of the digital asset sector this year would be a waste without proper consideration for scalability. He further remarked that experience has shown that the leaders in this crypto space are those with a massive userbase. Hence, blockchains must become highly scalable to make remittances and payments realistic.

A side benefit of this scalability is that the blockchains can now be used for additional use cases like NFT-integrated video games and social media capabilities. “Consequently, it is important to have a proper scaling schedule for this sector to enable it to accomplish the million TPS,” the FTX boss concluded.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.