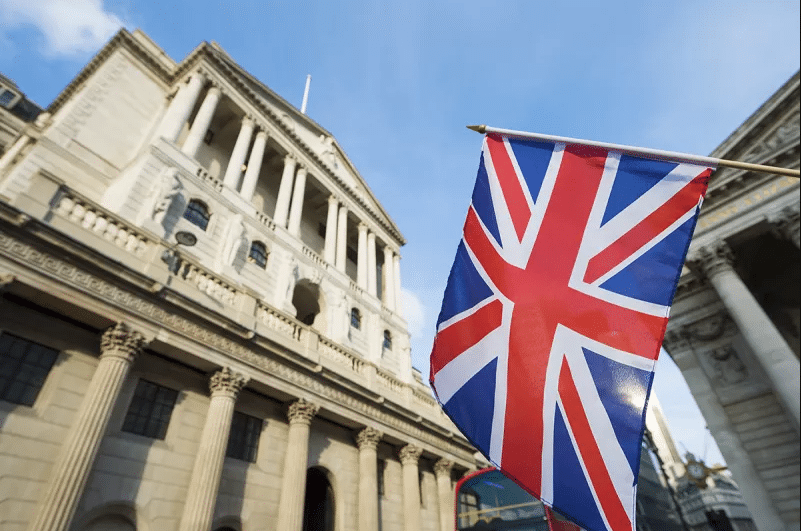

Sir Jon Cunliffe from BoE has suggested that the UK may likely issue a CBDC to ensure that public money remains available to the citizens.

Growing Demand for Digital Currency

Bank of England’s deputy governor for financial stability, Sir Jon Cunliffe reiterated that as more non-bank parties issue currency, digital public money could be a mainstay of confidence in the social circulation of money. Cunliffe made this assertion during an OMFF speech at the digital money institute in London. Cunliffe used past trends as justification for the present and future trends of private money circulation by commercial banks, pointing out that the last year’s Covid-19 outbreak has made it more compulsory and hastened the switch from public to private money for common payments.

A recent Bank of England survey showed that 70% of the people would prefer to use less cash for their transactions than the period before Covid-19. Most of them now prefer alternatives to physical cash such as internet transactions and contactless payments to complete their financial transactions. Ironically, commercial bank money keeps rising despite the switch from public money in terms of cash to private money. Cunliffe anticipates the launch of newer technologies which would likely cause major changes in the use and perhaps, the concept of money, along with its effects as a tool of social convention.

As non-bank, big tech players deploy tokenized and distributed ledger technologies, the market will become more exposed to more flexible, data-driven classes of money that provide new functionalities for the online space, he remarked. Cunliffe further said that central banks are already inundated with several queries regarding the adaptation of current frameworks being used by commercial banks for the cryptocurrency world. This becomes more important as new development (like micro-payment channels, smart contracts, programmable money, and stablecoins) continues to occur in the digital currency space.

Cunliffe opines that these tech-driven changes raise the question of whether central banks need to take action on the gradual decline in the value of publicly available money before it turns worse.

The Possible Introduction of a Physical CBDC

Before the bank of England publishes his study concerning these challenges, Cunliffe suggested that the introduction of public digital money (such as the central bank digital currency) in the form of physical cash may be a likely solution.

Thus, the public can have confidence in the uniform money since it has replaced all forms of money in the national economy. He opined that the bank of England’s solution to limit access to physical cash might not be a sustainable solution. Cunliffe said, “the state might have to release public digital money that suits modern life needs to retain public money that’s useful and available for UK citizens.”

Cunliffe also remarked that when there’s systemic stress, “confidence of private money might be undermined since they have the perception that they can’t access safe liquid assets or alternative forms of private money.” Financial stability in this respect can only be achieved through the issuance of a CBDC. Last year, Cunliffe advised the central bank to adapt to new developments in the banking industry and provide means to manage the aftermath of the financial and macro-economic consequences.

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.