New evidence by Santiment suggests that most bitcoin whales are also buying huge volumes of Ethereum, and it is now a proven fact that they own the largest percentage of the second leading cryptocurrency by marketcap.

Santiment’s Holdings Analysis

Santiment revealed that bitcoin whales (those owning between 100 and 10,000 bitcoin) started their Ethereum accumulation during the recent bitcoin price crash. Santiment says, “the whales keep buying more. The numbers have been rising since the beginning of the crash, but it has remained almost stagnant in recent days. Most of them can want to be early, and since they can afford it, they are doing so.”

The on-chain crypto analytics further said, “traders and investors have differing opinions on whether the bitcoin price will decline below $29K again or will start a bull trend. Thus, highlighting the huge fear, uncertainty, and doubt these traders still have about bitcoin. However, prices seemed to be rising out of crowd fear, even though it may have been short-lived. But the market’s move and the crowd’s expectation remain in the opposite direction.”

Santiment opined that bitcoin remains the king of virtual assets despite the recent market decline compared to the altcoins. Altcoin traders haven’t enjoyed better rewards than strong holders of bitcoin in the recent crypto price crash. Based on various metrics, altcoins declined most in the last 72 hours, with $doge declining by as much as 27%, yet bitcoin has only declined by about 4.7% within that same timeframe.

Ethereum Makes the Headlines

Meanwhile, Ethereum value looks set to increase further as the bank of Israel revealed that its central bank digital currency (CBDC) trial would be done using the Ethereum blockchain technology. Andrew abir, the bank of Israel’s deputy governor, revealed that the banking system has nothing to fear about the digital shekel as both of them will run parallel to each other.

Despite the news, there hasn’t been a significant rise in Ethereum price. It closed at around $1,780 yesterday night, but as this writing, it trades at about $1,770.

Altcoin Holders Might Experience Twice More Losses

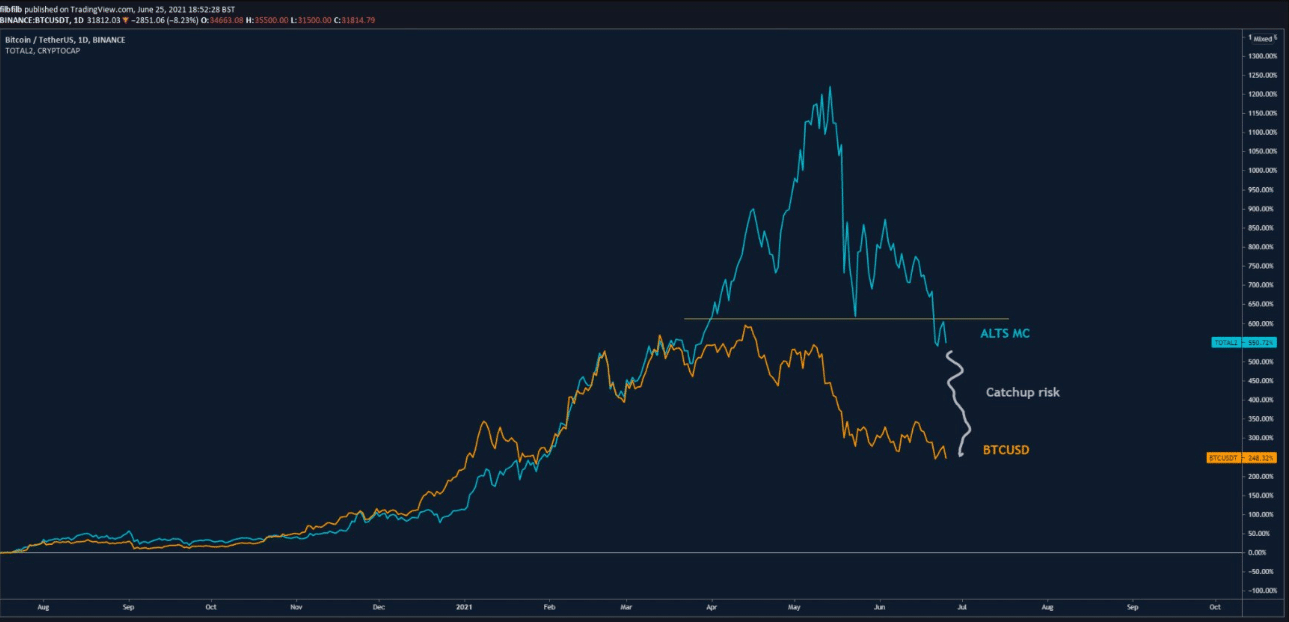

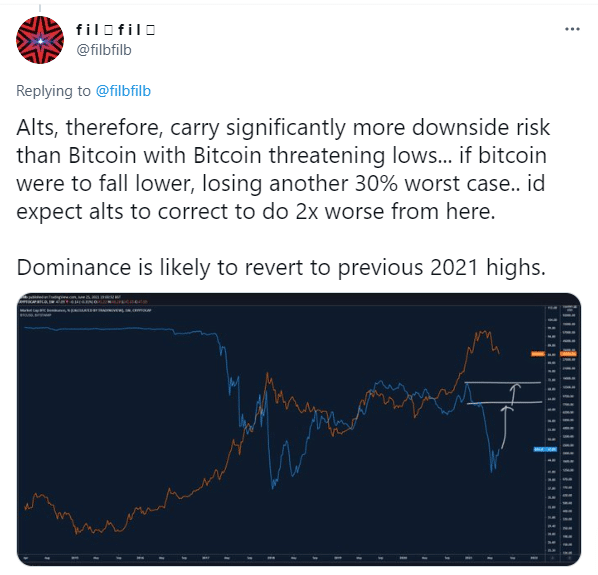

Co-owners of dencentrader trading suite and on-chain analytics firm, Filbfilb, have predicted that altcoins will decline twice further if bitcoin declines by another 32%. The onymous firm made this startling revelation in a tweet published late last night. It would be recalled that altcoins exploded around the same time when the flagship cryptocurrency stabilized around the $55,000 levels between March and May this year.

When bitcoin fell hard to around $29,000 recently, the altcoins crashed similarly.

Bitcoin price and altcoin market cap. Source: TradingView

The independent market analyst further revealed that altcoins have been playing catchup for some time now and predicted that any further decline in bitcoin price could cause altcoins to decline twice lower. The last two months’ decline of bitcoin has seen its year-to-date (YTD) performance reduce to about 5.8%. However, Ethereum’s YTD is currently at about 140%. Also, Dogecoin‘s YTD is currently at 4,120% despite declining by about 79% from its peak price.

Filfilb tweet. Source: Twitter

At Tokenhell, we help over 5,000 crypto companies amplify their content reach—and you can join them! For inquiries, reach out to us at info@tokenhell.com. Please remember, cryptocurrencies are highly volatile assets. Always conduct thorough research before making any investment decisions. Some content on this website, including posts under Crypto Cable, Sponsored Articles, and Press Releases, is provided by guest contributors or paid sponsors. The views expressed in these posts do not necessarily represent the opinions of Tokenhell. We are not responsible for the accuracy, quality, or reliability of any third-party content, advertisements, products, or banners featured on this site. For more details, please review our full terms and conditions / disclaimer.