Good Crypto Guide: What a Cryptocurrency Day Trading could look like with the best Portfolio Tracker on 35 Exchanges

Want to trade cryptocurrency or futures?

Everyone who has ever heard about trading on the cryptocurrency market, probably heard that this thing is not simple, but very interesting. However, everything depends not only on the skill and a tremendous amount of luck, but also on the right tools in the form of a strategy, a trading terminal and a portfolio tracker.

What is a Good Crypto?

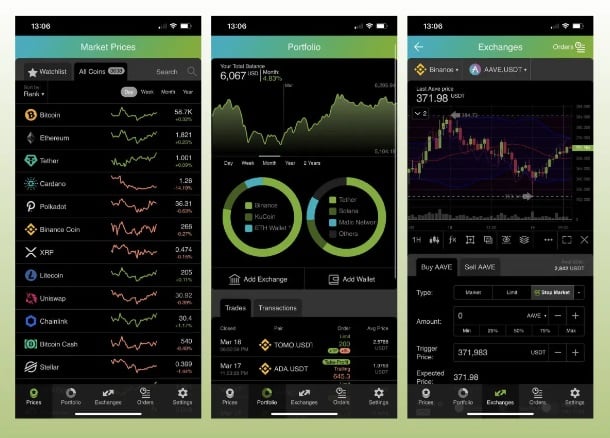

Good Crypto app is an advanced all-in-one trading and portfolio management app providing its users with a broad variety of most wanted tools that every profitable trader or investor should have in their pocket. GoodCrypto allows exploring over 20,000 markets and trading on 35+ crypto exchanges with advanced tools from one place, making successful trading available anytime and anywhere.

With GoodCrypto trading bots, your portfolio will work for you whenever you go, whatever you do, and for any trading strategy you choose. They help put off emotions to avoid all possible trading mistakes.

- Infinity Trailing bot will help you automatically trade with the advanced GoodCrypto Trailing Stop orders, “catching” all market ups and downs, and making a profit in any market situation.

- Grid Bot places and maintains an automated grid of buy and sell limit orders of the same size, allowing you to catch the slightest profit opportunity, especially in the ranging market.

- DCA bot will help you to gain profit even in a bearish market by averaging the position and “pulling” the Take Profit order closer to the current price while maintaining a given level of profitability.

Key Features

- Advanced Trailing Stop orders will help you to easily enter and exit positions at better prices, which can bring you much more profit, especially if you follow the trend for as long as possible.

- Stop Loss and Take Profit Сombos. TP and SL can be attached to any order (market, limit, etc.) in one click, with no balance freeze, by using the GoodCrypto app. Stop Loss trigger will allow you to avoid premature exit from a position on short-term price spikes.

- Smart alerts about market conditions, new exchange listings, and potential DeFi gems on Uniswap and Pancakeswap will be available before they explode. Set up the Good Crypto alerts for price changes or pool liquidity to catch any profit opportunities.

- Portfolio Tracking: Track all your exchange accounts, blockchain wallets, trades and Using a bollinger bands strategy can help you make a profit by predicting a breakout in a short or middle period of time. However, you need to remember that the bands cannot tell you a final advantage of which direction a breakout will take. IBy properly using the indicator you can better adapt to market movements by following the BB corridor and mostly relying on the previous trend direction in trades.

- Depending on how price consolidates, rebounds or breaks the midline, we can get a sign of price intentions to move in a certain direction, or a weakening trend, or an upcoming exit from the range, by the behavior of the candles relative to the BB walls.

- By using BB paired with other indicators, such as a GoodCrypto market trend signals, the strategy multiplies the potential profit. transactions in one place in real time, on the screen of the GoodCrypto app.

- Smart TA signals. An advanced Technical Analysis rating for each coin, based on 13 Moving Averages and 4 Oscillators will show you when it’s better to buy or sell an asset.

How to Use a Bollinger Bands Strategy

Inside the GoodCrypto platform there are many useful tools for technical analysis, but we will take a look at one of the popular trading strategies by the Bollinger Bands indicator. But it is better to use several arguments to enter a trade with your strategy, or additionally use the technical analysis signals module inside the application.

Using a bollinger bands strategy can help you make a profit by predicting a breakout in a short or middle period of time. However, you need to remember that the bands cannot tell you a final advantage of which direction a breakout will take. By properly using the indicator you can better adapt your trading strategy to the market movements by following the BB corridor and mostly relying on the previous trend direction in trades.

Depending on how price consolidates, rebounds or breaks the midline of indicator, we can get a sign of price intentions to move in a certain direction, or a weakening of the trend, or an upcoming exit from the range, by the behavior of the candles relative to the BB walls.

By using BB paired with other indicators, such as a GoodCrypto market trend signals, or using the functionality of the GoodCrypto pending orders without freezing the balance you will be able to place a significant number of setups according to such a strategy.

Breakouts

If you want to trade at the beginning of trends, you can use the Bollinger Bands strategy. Most of the time, prices stay within the bands. But when the asset price moves above the upper BB and below the lower BB, it’s a sign of the breakout. Traders look for a contraction in Bollinger Bands as this indicates a low volatility environment, it takes place before the breakout happens. After we pass the bands contraction, the volatility often tends to expand.

To trade breakouts successfully, you need to be patient, use the precise trading tools, and understand the market trends. Breakouts are often accompanied by a period of consolidation. Once price breaks through the bands, it is likely to reverse the direction of the mid-term trend. However, a long-term trend can also change the direction quickly, so it’s important to be ready to act immediately if the price breaks out. You can also apply the RSI indicator to improve your Bollinger Band signals, or also the technical analysis signals of a GoodCrypto platform. By using additional confirmations, you can increase the number of winning trades and decrease your overall number of losses.

Using Bollinger Bands as part of your strategy is a great way to use a range of technical indicators. RSI shows momentum around price areas that are valuable, while MACD is a powerful indicator of trend strength. No matter what combination of trading strategies you use, it is very important that a platform like GoodCrypto provides advanced trading tools and simplifies your work in order to achieve stable profits.

Pricing

GoodCrypto app provides you with all the advanced features, including the most wanted trading bots, for just $9.99/mo.

Moreover, you can save some money by signing up for the yearly plan, which costs only $79.99/year ($6.66/mo).

It doesn’t charge any additional trading fees on top of what the exchanges do.

Supported Exchanges

GoodCrypto is fully supported 35+ TOP crypto exchanges including:

Binance, Coinbase Pro, Huobi, Mandala, Binance.US, Bitfinex, Bithumb, BitMart, MitMEX, Bitstamp, Bittrex, Blockchain, Bybit, Bybit Spot, CEX.io, Crypto.com, Exmo, FTX, FTX US, Gate.io, Gemini, HitBTC, Huobi Futures, Indodax, Kraken, KuCoin, KuCoin Futures, Kuna, Liquid, OKX, Phemex, Poloniex, Tokocrypto, and Coinbase.

Good Crypto is available in the iOS App Store, Android Play Store, and Web, so download it now and make profitable trading available 24/7!

Tokenhell produces content exposure for over 5,000 crypto companies and you can be one of them too! Contact at info@tokenhell.com if you have any questions. Cryptocurrencies are highly volatile, conduct your own research before making any investment decisions. Some of the posts on this website are guest posts or paid posts that are not written by Tokenhell authors (namely Crypto Cable , Sponsored Articles and Press Release content) and the views expressed in these types of posts do not reflect the views of this website. Tokenhell is not responsible for the content, accuracy, quality, advertising, products or any other content or banners (ad space) posted on the site. Read full terms and conditions / disclaimer.